Is your property suitable for short-term letting?

Focus: A 2026 guide to UK market potential

To succeed in the UK’s evolving holiday let market, a property needs more than just a "live" listing. It requires a strategic alignment of location, compliance, and guest demand. At Pass the Keys, we use proprietary data to assess whether your property will outperform traditional buy-to-lets.

Below are the four pillars we use to evaluate property suitability and market potential.

1. Location and local demand drivers

In 2026, "location" is defined by more than just proximity to a beach or city centre. We look for multi-channel demand to ensure year-round occupancy.

Leisure hotspots: Proximity to Grade I/II* heritage sites, National Parks, or major event hubs (like the Chester Racecourse or Edinburgh Fringe).

The "Bleisure" factor: Locations near major business districts or transport hubs (like HS2-adjacent areas or tech hubs) attract the growing "business + leisure" demographic.

Mid-term potential: Properties in "commuter belt" towns (e.g., Slough, Reading, or Milton Keynes) are seeing a surge in 2–12 week stays from relocating professionals and insurance-claim guests.

2. Physical suitability and "Operational Drag"

Not every beautiful home makes a profitable short-term let. We assess the Operational Drag—the physical factors that can eat into your margins.

Access and entry: 24/7 self-check-in is a 2026 non-negotiable. If your property is in a managed block with a concierge or restrictive gates, we evaluate how to implement smart-lock technology without breaching building rules.

High-spec amenities: Properties that "win" the click usually feature a king-sized bed, dedicated workspace (with mesh Wi-Fi), and hotel-standard finishes.

Maintenance efficiency: We look for properties where cleaning and turnovers can be completed within a standard 4-hour window to keep your costs down.

3. UK regulatory compliance & safety

Since the introduction of the 2025 Short-Term Let Registration Scheme in England and existing licensing in Scotland, compliance is the first step in suitability.

Fire Safety (Article 50): Your property must meet the 2024 updated Home Office guidelines for small paying-guest accommodation. This includes interconnected smoke alarms and fire-rated doors.

Planning permission: We check your local authority’s stance on "Change of Use." In London, we manage your 90-night limit; in "Control Zones," we assist with full planning applications.

Leisure vs. leasehold: We review your head lease or mortgage terms to ensure there are no restrictive covenants preventing short-term occupation.

4. Market potential: The ROI calculation

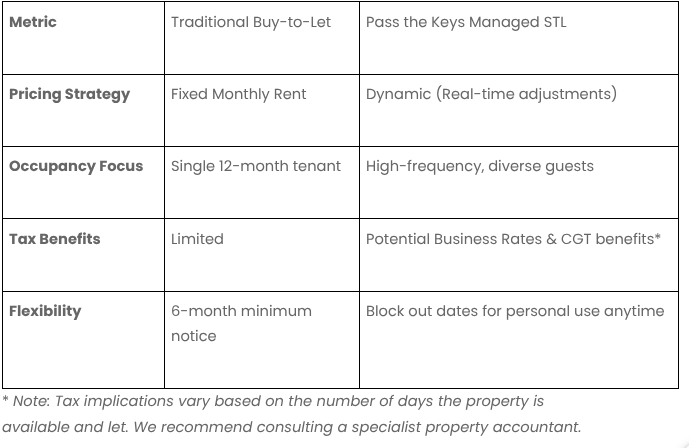

We move beyond "gross revenue" and focus on Net Yield. A property has high market potential if its projected short-term income exceeds traditional AST (Assured Shorthold Tenancy) income by at least 30–50% after all costs.

Common questions on property suitability

What is the best type of property for Airbnb in the UK?

The highest ROI in 2026 is currently found in two extremes: compact, high-spec city-centre apartments with excellent transport links for corporate guests, and large, "unique" rural homes (barn conversions or cottages) that offer a USP that competitors cannot easily replicate.

How do I know if my property will be profitable?

Profitability is determined by your RevPAR (Revenue Per Available Rental). We calculate this by multiplying your projected Average Daily Rate by your expected Occupancy Rate. In the UK, a "good" occupancy rate for a managed property is typically 65% or higher.

Can I short-let a leasehold flat in the UK?

Yes, provided your lease does not explicitly forbid it. Many modern developments now have "Airbnb-friendly" clauses, but it is vital to check your specific leasehold agreement for covenants against "business use" or "short-term occupation." You may also need to check the local council rules on short-let accommodation as relevant planning permission may need to be applied for.

Get started today or speak to a host advisor

Book a call with our host advisors today and have all of your questions answered