What’s the difference between long-term and short-term letting?

Focus: Highlighting the pro's and con's of both models

Introduction

Short-term and long-term lets are separated by five core differences: income, regulations, flexibility, tax and effort. Understanding these fundamentals will help you determine which option aligns with your financial and lifestyle goals.

If you own a property and you are considering the best rental option, you have no doubt wondered whether it is better to let it out on a long-term tenancy, which has been the traditional option for landlords for many years or consider short letting through platforms like Airbnb or Booking.com.

Both can make you money and have benefits as well as disadvantages. It can feel overwhelming to know which option is the best solution. Too often, we hear that it is “easier” to sell the property or to go down the traditional route of long letting; however, this is not always the right solution and gathering all the right information upfront to make an informed decision on whether a short let/holiday let could be more viable and give you better returns.

In this article, we explore these key differences between long-term and short-term letting, and how to determine which approach is right for you and your property.

Five differences between long-term and short-term letting

Long term letting is the more traditional method of letting out your property and the occupants would be classed as tenants. Typically, you would comply with a number of legal obligations that make your property adhere to standards to keep tenants safe. The length of contract typically is anywhere from a year upwards.

A short term let or holiday let is an agreement that is typically less than six months. They are usually booked via short let platforms like Airbnb, Booking.com etc. The occupiers are typically called guests.

“We’ve seen steady guest behaviour year on year, with the average stay length rising from 4.41 nights in 2024 to 4.54 in 2025,” says Alexander Lyakhotskiy CEO of Pass the Keys . “It’s a slight uplift, but it reinforces the stability of the short-let market.”

Long term lets are typically better for stability but short term lets could be better if you are looking to maximise profits.

1. Income and profit potential

This table compares the income and profit potential of long-term lets to short-term lets:

Short-term lets can generate significantly higher revenue, especially in popular or high-demand areas, but they require more involvement or professional management.

Income with long lets is predictable as long as you have a good stable tenant. Short lets tend to follow a bell curve pattern. Revenue peaks during high demand seasons and other major events and can go quieter during other periods. This is because of the fluctuating occupancy rates and nightly rates which vary throughout the year. In some destinations hosts/ landlords can earn the majority of their annual income.

“While demand for short-term rentals is strong throughout the year, especially for city breaks and festive periods, the undisputed peak season for Pass the Keys' guest stays generally runs from late spring (Easter/May Bank Holidays) through the end of summer (late September). This period is fueled by school holidays and the high tourist season." Wesley Brown - COO Pass the Keys

2. Taxes

Short-term letting has historically provided greater tax breaks and incentives over long-term letting. Unfortunately, following changes in tax legislation from April 2025, short and long term lets will now be taxed in the same way. If you short-term let a property, you would be liable for the council tax. However, short-term lets can obtain a ‘business rating’, allowing them not to pay any council tax. Most short-term lets will qualify for small business rates relief, meaning no business rates or council tax payable.

Short-term lets are subject to VAT if the rents received from short-term letting exceed £90,000 in any 12 month period. It is, however, possible to register under the ‘flat rate’ VAT scheme, reducing VAT payable to only 10.5%. Long-term lets in ‘off seasons’ (October to Easter) are generally not subject to VAT (source: https://gozeal.co.uk)

3. Stability vs flexibility

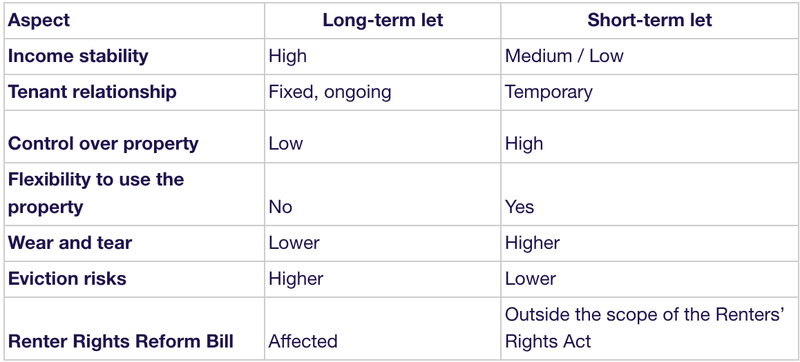

This table compares the stability and flexibility of long-term letting and short-term letting:

We know that the market conditions at the moment, with the budget uncertainty, buyers leading to the first annual decline in sales of property in two years. There are 7% more homes on the market, and buyer demand is down by 8% (source: Zoopla), which means short lets could also be a viable option whilst the property is on the market.

Short lets have traditionally been thought to cause more wear and tear on a property because of the higher footfall, but this is not always the case. Yes, there may be more guests, but equally, you have someone dealing with changovers and regularly cleaning and spot checking the property, vs a long let when there is no control of this.

Paul Wheeler, owner of Pass the Keys - North West London, "Having managed both long and short lets, it's not as black and white as having a long let tenant will reduce the wear & tear. With Short lets, there is a clean between each guest, whereas with long-term lets, you are relying on a tenant to keep the property clean. It is not uncommon for a tenant never to clean a property during their whole tenancy, which can cause additional wear and tear and normally ends in a dispute with the deposit that the tenant has paid."

If you're looking for a steady, reliable source of income, then long-term letting may be more suitable. If you're looking for more flexibility, then consider the short let market. This will be even more important with the Renter Rights Reform Bill (explained later on).

4. Regulations in 2025/2026

With the marketplace ever changing, keeping up to date on what is happening across the letting landscape is more important than ever.

Long let regulations

The long-term market has the Renter Rights Reform Bill coming into effect for long-term lets. The Renters’ Rights Act 2025 changes Section 21 and brings tighter controls on rent and possession(refers to Section 21 of the Housing Act 1988 in England and Wales). Section 21 allowed landlords to evict tenants without having to give a reason, once the fixed term had ended, as long as they followed the correct notice procedure (typically giving 2 months’ notice).It was mainly used when looking to sell the property, if you wanted to move back in or ending tenancies with problematic tenants. It basically allowed landlords to maintain some control of their assets with minimal legal risk.

Many landlords see the changes to Section 21 as a backwards step for landlords. It means it will be slower and harder for landlords to remove tenants and will likely increase court involvement. This is another blow to the long-term market after many tax changes and EPC requirements.

The good news is that short-term letting sits outside of the scope.

Short let regulations

Short-term lets (like Airbnb-style stays) do not fall under the Renter Rights Reform Bill legislation, because guests are licensees, not tenants, meaning they don’t acquire the legal rights or protections the Bill creates.

You will, however, need to consider short-let regulations in certain areas, different regulations such as the 90-day rule in London or the licensing in Edinburgh and other locations. A credible property management company will be able to advise on this in your specific area and, in most cases, be able to help when it comes to licensing. You also need to consider building management freeholders, leases and local restrictions with some councils. There are also safety, fire and insurance obligations to consider.

5. Management and effort

Long-term letting

Long-term lets are more “hands-off” once a tenant is in, the monthly rent simply comes in, and your involvement is minimal. Repairs and compliance still apply.

Short-term letting

Short-term letting is far more operational; cleaning, guest communication, check-ins, marketing, and maintenance all needing attention.

That’s why many hosts use professional management companies to handle everything, from guest screening to pricing optimisation.

In most cases, both options will require management and therefore, the time commitment to the landlord is minimal if you pick a reliable, credible property management company.

Which option is right for you?

Both long-term and short-term letting in the UK can be profitable and valuable depending on your situation. The key is understanding what your risk appetite is, your income goals and your flexibility needs.

If you prefer a reliable income and are not worried about being tied into a long-term tenancy, this may suit you best but regulations are making long let more restrictive.

If you want to maximise income potential, mitigate the risk of tenants not paying whilst avoiding the new Renters' rights reform, short letting allows you to keep that freedom and could be the smarter choice if you have the right management company and professional advice.

Get started today or speak to a host advisor

Book a call with our host advisors today and have all of your questions answered